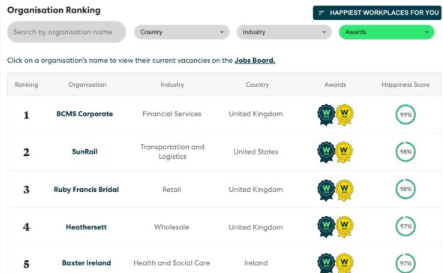

World’s Happiest Workplaces List

The World’s Happiest Workplaces List is a live ranking with insights into how happy employees are where they work.

- Rankings are based on the data collected through our free Happy At Work Test.

- Add and apply filters to find the happiest workplaces for you.

- Take our Happy At Work Test to enter your workplace into the World’s Happiest Workplaces Awards.

Find out more about our awards, sponsors and partners here.

2025’s Best Finance Organisations to Work For in the UK

| Rank | Organisation | Happiness Score | Country |

| 1 | Iplicit | 96% | United Kingdom |

| 2 | ZZPS | 95% | United Kingdom |

| 3 | Monavate | 95% | United Kingdom |

| 4 | Kuflink | 94% | United Kingdom |

| 5 | Goldex | 93% | United Kingdom |

| 6 | DLL Financial Solutions | 93% | United Kingdom |

| 7 | Intellica | 93% | United Kingdom |

| 8 | Storfund | 93% | United Kingdom |

| 9 | Yealand Fund Services | 93% | United Kingdom |

| 10 | Stone Osmond | 92% | United Kingdom |

Notable Finance organisations featured

Other notable UK Finance organisations featuring on the World’s Happiest Workplaces List include:

Permira – With a Happiness Score of 89%

Julius Baer – With a Happiness Score of 87%

Funding Circle – With a Happiness Score of 86%

Why is workplace happiness so important in Finance?

The finance sector has long been characterised by its demanding culture, intense pressure, and gruelling hours. Yet an increasing body of evidence suggests that prioritising employee happiness is not merely a moral imperative but a strategic necessity for financial institutions seeking sustained success.

The Cost of Unhappiness

Unhappy employees in finance carry significant costs that extend far beyond simple productivity metrics. When staff members feel undervalued or burnt out, mistakes multiply. In an industry where a single error can result in regulatory breaches, substantial financial losses, or reputational damage, the stakes are exceptionally high. Research consistently demonstrates that stressed, dissatisfied employees make more errors in judgement, overlook critical details, and struggle with the complex decision-making that financial services demand.

Staff turnover represents another substantial burden. Recruiting and training financial professionals requires considerable investment, particularly for specialised roles in investment banking, wealth management, or compliance. When talented employees depart due to workplace dissatisfaction, institutions lose not only their financial investment but also invaluable institutional knowledge and client relationships built over the years.

Enhanced Performance Through Wellbeing

Happy employees demonstrably perform better. In finance, where analytical thinking, creativity in problem-solving, and client relationship management are paramount, positive workplace experiences directly correlate with improved outcomes. Satisfied staff members exhibit greater resilience when navigating market volatility, regulatory changes, and complex client needs.

Moreover, employee happiness fosters innovation. Financial institutions that cultivate positive work environments encourage their teams to propose new solutions, challenge outdated practices, and develop creative approaches to evolving market challenges. This innovative capacity has become increasingly vital as fintech disruption reshapes the competitive landscape.

Client Relationships and Trust

The finance industry fundamentally depends on trust. Clients entrust financial institutions with their assets, their futures, and often their most sensitive information. Happy employees are better equipped to build and maintain these crucial relationships. They demonstrate greater patience, empathy, and genuine engagement with clients, creating experiences that foster loyalty and generate referrals.

Conversely, dissatisfied employees often provide substandard service. They may rush through client interactions, fail to identify opportunities to add value, or struggle to communicate effectively during challenging market conditions. In wealth management and private banking particularly, where relationships can span decades, the quality of these human connections often determines success.

Attracting and Retaining Talent

The finance industry faces intensifying competition for top talent, not only from other financial institutions but also from technology companies, startups, and consultancies. Younger generations of professionals increasingly prioritise workplace culture, work-life balance, and meaningful work over traditional markers of success like salary and status alone.

Institutions known for valuing employee wellbeing enjoy significant advantages in recruitment. They attract higher-quality candidates, reduce time-to-hire, and build stronger employer brands. Equally important, they retain their best performers, avoiding the constant disruption and knowledge loss that accompanies high turnover.

Regulatory Compliance and Risk Management

Happy and engaged employees are more vigilant about compliance and risk management. They take ownership of their responsibilities, report concerns without fear, and maintain the attention to detail that regulatory requirements demand. Financial institutions operating under increasingly stringent oversight cannot afford the lapses that often accompany workplace dissatisfaction.

Furthermore, positive workplace culture reduces the likelihood of misconduct. Employees who feel valued and fairly treated are less likely to engage in unethical behaviour or to overlook concerning practices amongst colleagues. This ethical foundation protects institutions from the scandals that can devastate reputations and balance sheets alike.

The Business Case is Clear

Whilst the finance industry has traditionally glorified long hours and intense pressure as badges of honour, this culture proves counterproductive. The evidence overwhelmingly supports prioritising employee happiness as a sound business strategy. Financial institutions that invest in their people’s wellbeing see measurable returns through improved performance, reduced turnover, stronger client relationships, and enhanced risk management.

The most successful financial institutions will be those that recognise their employees as their greatest asset, worthy of the same careful attention and strategic investment given to any other critical resource. In an industry built on managing risk and maximising returns, the return on investment in employee happiness has become impossible to ignore.

Explore a vast array of helpful content on navigating a career in Finance on our Resource Centre!

Career Paths in the Finance Industry

The finance industry offers a remarkably diverse range of career trajectories, each with distinct responsibilities, skill requirements, and progression opportunities. Understanding these pathways can help professionals navigate their careers strategically.

Investment Banking: Investment banking attracts many ambitious finance professionals seeking high earnings and exposure to major corporate transactions. Analysts typically start by building financial models, conducting research, and preparing pitch materials, often working extremely long hours. After two to three years, successful analysts progress to the associate level, taking on more client interaction and deal management responsibilities.

The progression continues through vice president to director and eventually managing director roles, with each level bringing greater client responsibility, deal origination expectations, and leadership duties. Many professionals exit investment banking after several years, leveraging their experience to move into private equity, corporate development, or senior finance roles in industry.

Corporate Banking and Lending: Corporate banking professionals manage relationships with business clients, providing lending, treasury services, and financial advice. Relationship managers build portfolios of corporate clients, understanding their businesses and proposing appropriate financial solutions. Career progression typically moves from assistant relationship manager through various relationship management grades to senior or portfolio management positions.

This path tends to offer better work-life balance than investment banking whilst still providing substantial earnings potential. Successful corporate bankers combine financial acumen with strong interpersonal skills and a deep understanding of specific industries or sectors.

Asset and Wealth Management: Asset management careers involve making investment decisions on behalf of clients, whether institutional investors or wealthy individuals. Junior analysts research companies, industries, or asset classes, supporting portfolio managers who make final investment decisions. Progression leads to portfolio management responsibilities, initially for smaller funds before potentially managing flagship products.

Wealth management focuses on advising high-net-worth individuals on their entire financial situation. Wealth managers or private bankers build trusted relationships with clients, coordinating investment strategy, estate planning, and sometimes lifestyle services. Career advancement typically involves managing larger client portfolios and eventually bringing in new business.

Retail and Commercial Banking: High street banking offers numerous career pathways, from branch management to product development. Branch staff might progress from customer service roles through personal banking and eventually to branch management positions. Commercial banking focuses on small and medium-sized enterprises, with relationship managers progressing similarly to corporate banking colleagues but serving smaller businesses.

Regional and head office roles in credit risk, operations, marketing, and strategy provide alternative progression routes for those who prefer analytical or strategic work over client-facing positions.

Trading and Sales: Trading floors employ both traders, who buy and sell securities for the bank’s own account or clients, and salespeople, who maintain relationships with institutional clients. Junior traders typically start on graduate programmes, learning from senior traders before gradually taking on more responsibility and risk limits. Top traders can earn exceptional compensation but face intense pressure and potential redundancy during market downturns.

Sales roles require building deep client relationships whilst understanding markets sufficiently to provide valuable insights. Progression moves from junior salesperson through various grades to head of sales for particular products or regions.

Risk Management: Risk professionals identify, measure, and mitigate various risks facing financial institutions. Credit risk analysts assess borrowers’ likelihood of repayment. Market risk specialists monitor trading activities and potential losses. Operational risk teams identify process weaknesses and control failures.

Career progression typically moves from analyst roles through senior analyst and manager positions to head of risk for specific departments or regions. Chief risk officers occupy some of the most senior and well-compensated positions in finance, reflecting the critical importance of risk management following the 2008 financial crisis.

Compliance and Regulation: Compliance professionals ensure their institutions meet regulatory requirements and internal policies. This field has expanded dramatically as regulatory oversight has intensified. Careers progress from compliance analyst through manager and head of compliance positions, potentially leading to general counsel or chief compliance officer roles.

Those with legal backgrounds often thrive in compliance, though many successful professionals come from operational or front office backgrounds, bringing a practical understanding of business activities.

Actuarial Work: Actuaries work primarily in insurance and pensions, using mathematics and statistics to assess financial risks. The profession requires passing rigorous examinations whilst working, typically taking several years to achieve full qualification. Qualified actuaries can progress to chief actuary positions or move into broader risk management, pricing, or strategic roles.

Financial Technology and Innovation: Fintech roles have proliferated as technology reshapes financial services. These careers might involve developing trading algorithms, building digital banking platforms, implementing blockchain solutions, or creating data analytics capabilities. Progression varies widely depending on whether professionals work for traditional institutions or fintech startups, but successful individuals can reach chief technology officer, chief information officer, or senior product development positions.

Accounting and Finance Functions: Corporate finance teams within financial institutions manage internal financial reporting, budgeting, forecasting, and strategic planning. Qualified accountants often start as financial analysts before progressing through finance manager roles towards chief financial officer positions. These careers offer exposure to senior leadership whilst typically maintaining a reasonable work-life balance.

Consulting and Advisory: Financial services consulting involves advising institutions on strategy, operations, technology, or regulatory challenges. Consultants typically progress from analyst through consultant, manager, and director grades to partner level. This path offers variety, intellectual challenge, and broad industry exposure, though often demanding extensive travel and long hours.

Explore our Jobs Marketplace to find the best Finance job in the right organisation.

WorkL Communities

WorkL Communities are now live! Whether you are passionate about the latest trends in the Finance industry, seeking advice, looking for the latest industry insights or to network with fellow professionals, this community has you covered.

Join the Financial Services Community here!